How to Perform Horizontal and Vertical Analyses of Income Statements

For example, the cash balance at the end of one accounting period can be compared to other accounting periods. Once you have your company’s values for the variables of interest, you need to find those of similar companies in your have a new electric car don’t forget to claim your tax credit industry for the selected time periods. Sometimes you may find horizontal analysis reports, saving you the calculations, but you can always calculate the percentage change yourself using publicly available financial data.

Best Excel Courses For Finance And Accounting In 2024

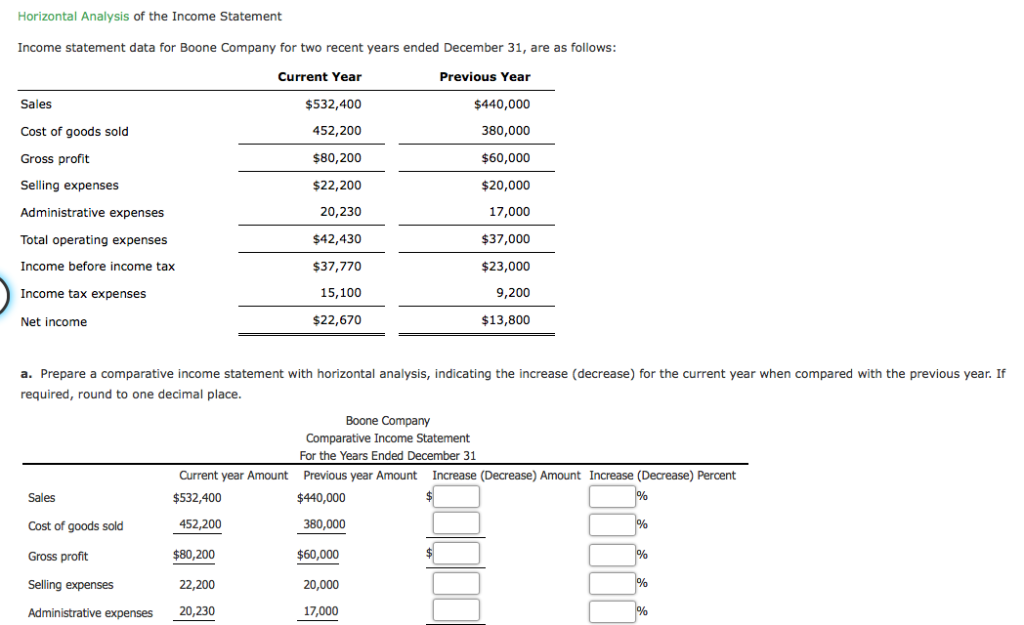

If the cost of goods sold amount is $1 million, it will be presented as 50% ($1 million divided by sales of $2 million). Horizontal analysis is important because it allows you to compare data between different periods and makes it easier to identify changes in trends. This can be helpful in making decisions about whether to invest in a company or not. In this case, if management compares direct sales between 2007 and 2006 (the base year), it is clear that there is an increase of 3.2%. You can also use horizontal analysis in conjunction with both the balance sheet and the income statement. For example, if the base year amount of cash is $100, a 10% increase would make the current accounting period’s amount $110, whereas a 10% decrease would be $90.

Accounting Ratios

- In analyzing the income statements of a retail company, an analyst notices steady annual growth in revenue over the past five years.

- Both horizontal and vertical analysis have limitations but provide useful insights when analysing financial statements.

- So grab your calculator and get ready to decode your financial statements like a pro.

- Trend Analysis is a technique used to identify trends spanning different accounting periods by highlighting the changes in different financial statements when comparing items to each other.

The most significant insight that percentage change analysis provides is the identification of growth or decline rates in financial metrics such as revenue, expenditures, and profits. Investigation and remedial measures could turn out necessary in response to declining rates. By employing the same methodology on other accounts, it is possible to determine whether their percentage increases or decreases in comparison to the base year. Analysts are interested in observing positive trends and enhanced profit margins. In this second example, I will do a horizontal analysis of Company B’s current assets based on the annual balance sheets. In the next section, you have step-by-step instructions on how to do horizontal analysis with examples using a balance sheet and an income statement.

What is the approximate value of your cash savings and other investments?

This type of question guides itself to selecting certain horizontal analysis methods and specific trends or patterns to seek out. Last, a horizontal analysis can encompass calculating percentage changes from one period to the next. As a company grows, it often becomes more difficult to sustain the same rate of growth, even if the company grows in pure dollar size. This percentage method is most useful when identifying changes over a longer period of time where there may be significant deviations from the base period to the current period.

Example of Comparative Balance Sheet with Horizontal Analysis

Conversely, a decrease in operating expenses might suggest improved operational efficiency or cost-cutting measures that are bearing fruit. Given below is a horizontal analysis in excel of a comparative income statement (i.e. year 1 – base, year 2, and year 3). As a result, some companies maneuver the growth and profitability trends reported in their financial horizontal analysis report using a combination of methods to break down business segments. Regardless, accounting changes and one-off events can be used to correct such an anomaly and enhance horizontal analysis accuracy. Consistency constraint here means that the same accounting methods and principles must be used each year since they remain constant over the years. Conceptually, the premise of horizontal analysis is that tracking a company’s financial performance in real time and comparing those figures to its past performance (and that of its industry peers) can be very practical.

Revenue growth is often the first metric examined, as it provides a clear picture of how a company’s sales are evolving over time. By comparing revenue figures from different periods, analysts can gauge whether the company is expanding its market presence or facing challenges in maintaining its sales levels. This metric is especially useful for identifying seasonal trends or the impact of market conditions on the company’s performance. The horizontal analysis evaluates trends Year over Year (YoY) or Quarter over Quarter (QoQ).

Additionally, explore how vertical and horizontal analyses provide insights into trends and expense structures, and apply your understanding to interpret income statement data in CFA-style scenarios and practice questions. Carrying out horizontal analysis of the income statement and balance sheet helps investors and creditors to determine the current financial position of a company. By looking at past performance, it can help assess growth rates, spot trends (by comparing changes from period to period), generate forecasts, or project the insights gained into the future. Horizontal analysis can help evaluate a company’s financial standing or position vis-à-vis its competitors. It’s frequently used in absolute comparisons but can be used as percentages, too. Horizontal analysis, also known as trend analysis, compares financial data over a specific period to identify changes and trends.

To standardize the output for the sake of comparability, the next step is to divide by the base period. Horizontal analysis is most useful when an entity has been established, has strong record-keeping capabilities, and has traceable bits of historical information that can be dug into for more information as needed. This type of analysis is more relevant for analyzing the value when selling or acquiring the business. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time. In addition to helping you determine your company’s current financial health, understanding income statements can help you predict future opportunities, decide on business strategy, and create meaningful team goals. Horizontal and vertical analysis are commonly used by financial analysts, investors, and managers to gain insight into a company’s financial performance and to make informed decisions based on the analysis. An example of horizontal analysis is comparing amounts from a company’s balance sheet or income statement over subsequent time periods to observe trends.